We've put together this guide to help you learn more about pawnbrokers' services, work out whether taking out a pawnbroker loan is the best choice for you, and ensure that you know exactly what you're getting into if you decide to go down this route. Read on to learn everything you need to know.

Do pawn shops give loans?

Pawnbrokers offer secured loans, which allow you to use your personal property as collateral. This means, if you need to borrow money but can't get a traditional loan or credit card for one reason or another, a pawn shop can offer the perfect alternative.

As we explain in our guide to the difference between secured and unsecured loans, pawn loans are easy to maintain and, if you borrow from us, you can pay back the money at any stage during the six-month contract. Pawn loans allow you to borrow based on the value of the asset and not on your personal credit history. Often, a pawn loan can be cheaper than a short term or payday loan.

However, as well as advantages, there are some potential disadvantages to pawnbroker loans. You need to consider that, if you fail to meet the agreed repayments, the lender can claim the item(s) you've secured your loan against.

What does pawn mean?

If you pawn an item, you give it to a pawnbroker as collateral in order to obtain a loan. If you can't make the agreed repayments, the pawnbroker you've borrowed from will keep the item to cover their costs. This means whatever you pawn must be worth at least the amount you're looking to borrow. If you do make the payments as agreed, your item will be returned.

Lots of people confuse pawning an item with selling an item.

What can you pawn?

Every pawnbroker will have different assets they can accept when considering a loan request, so it's important that you consult them to see if your item is suitable.

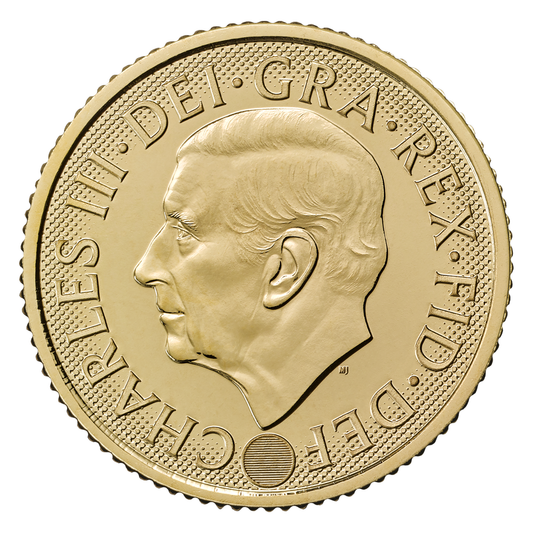

Here at H&T, our secured pawn loans and high-end pawn loans can be secured against a selection of valuables, including cars, jewellery, antiques, and watches.

What are the advantages of pawnbroker loans?

There are a range of reasons why people choose to opt for pawnbroker loans over taking out alternative types of credit. Here are just some of the benefits that they offer:

- They're quite easy to obtain: As a pawn loan is based purely on the value of the asset, and not on the applicant’s income and expenditure or credit history, pawn loans can be offered to those who may not be able to access more traditional loan products.

- It's fast: Securing a pawnbroker loan is quick and easy. You'll often be able to get the money you need on the same day that you apply.

- Interest rates tend to be lower: When compared to short term loans or payday loans, the interest rates of secured loans are often cheaper.

- You can typically borrow larger amounts: As secured loans give lenders an extra layer of protection, they’ll often allow you to borrow more than you could with an unsecured loan. Generally, the most you can borrow with an unsecured loan is £35,000, while secured loans go up to £75,000 (our secured loans have a maximum of £50,000, although you can secure up to £1 million with one of our high-end pawn loans). You just need to make sure your assets are worth the amount you’re looking to borrow.

What are the disadvantages of pawnbroker loans?

Of course, while pawn loans do have their benefits, there are some reasons why they might not be the best option for you. Here’s what you need to consider:

- You need at least one valuable asset to use as collateral: In order to take out a pawnbroker loan, you need to have something that you can secure it against. The value of your asset must be at least equal to the amount you wish to borrow. So, if you don’t have any items that are valuable enough and that you’re willing to put forward as collateral, you may not be able to secure the loan you’re looking for.

- You’ll lose your item(s) if you don’t make the repayments: As a pawnbroker loan is secured against the item(s) you’ve offered as collateral, you are liable to lose those items if you fail to make your repayments. However, reputable pawnbrokers and pawn shops will help you find a repayment plan that works for you.

- The pawnbroker will keep your asset for the loan term: As the loan is secured against an asset, the pawnbroker will keep the asset until the loan is fully repaid. This means you cannot have access to the asset during the loan term.

What happens if you can't pay your pawnbroker loan back?

When you take out a pawnbroker loan, it will need to be secured against at least one asset, such as some jewellery, a watch, or artwork. This gives lenders an extra level of protection because, if you find yourself unable to make the repayments, they can claim your item(s) to cover the cost of the loan.

It is therefore important that you have budgeted for the repayments prior to taking out the loan. You also need to consider that if something does go wrong, you can deal with the emotional detachment of having it taken from you. Be hesitant in offering any assets that hold sentimental value to you.

Do pawn shops ask for ID?

Yes, any good pawnbroker should ask for your ID to verify who you are. Here at H&T, we accept a formal letter with your address that you've received within the last three months — for example, a utility bill or tenancy agreement — or you can show us valid photographic ID like a passport or driving licence.

If you’ve long wondered what a pawnbroker is and how they work, you should now have a much better understanding of their services. Pawnbroker loans offer a handy alternative to other kinds of borrowing if your credit score isn’t the strongest or you need money fast. If you think taking one out might be the best solution for you, apply online to take out a secured loan with us today.

REPRESENTATIVE 165.5 % APR

Representative Example: Total amount of credit: £200 for 6 months. Total amount payable in one instalment: £325.88. Total charge for credit: £125.88(Interest Only). Interest rate 125.9% pa(fixed). Maximum APR 165.5 %APR. Maximum payment term up to 6 months.

Pawnbroking Loans are secured on your items, if the loan is not repaid it will be sold to pay the debt.

Authorised and regulated by the Financial Conduct Authority for Consumer Credit. (Please note that Cheque Cashing, FX, retail purchases and sales are not regulated by the FCA.)